utah non food tax rate

Use the Use Tax Rate List below to get the rate for the location where the merchandise was delivered stored used or consumed. The area rate becomes the final tax rate charged by counties against the assessed value of a specific property.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

It does not contain all tax laws or rules.

. With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more. 89 rows These rate charts are not intended to be used by non-nexus filers to source out-of. Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

1 entity and 2 area. A group of entity rates make up the area rate. Utah has a single tax rate for all income levels as follows.

TAP will total tax due for you. Out-of-state sellers should source their sales based on the ZIP 4 of the customers address. 2022 Utah state sales tax.

Non-food and prepared food sales. It does not contain all tax laws or rules. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

Therefore the taxable value is only 55 of fair market value. Detailed Utah state income tax rates and brackets are available on this page. 274 rows Utah has state sales tax of 485 and allows local governments to collect a local.

Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda. You must file a Utah TC-40 return if you. For security reasons TAP and other e-services are not available in most countries outside the United States.

See the instruction booklets for those years. Local rates which are collected at the county and city level range from 125 to 420. The tax on grocery food is 3 percent.

In the state of Utah the foods are subject to local taxes. Depending on local jurisdictions the total tax rate can be as high as 87. Click here to get more information.

There are two types of tax rates. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. On the other hand the taxable value of a second residence or an unoccupied.

Both food and food ingredients will be taxed at a reduced rate of 175. Exact tax amount may vary for different items. However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. The federal corporate income tax by contrast has a marginal bracketed corporate income taxUtahs maximum marginal corporate income tax rate is the 3rd lowest in the United States ranking directly below North Dakotas 5200. Tax calculation grocery food sales.

The Utah UT state sales tax rate is 47. This means that depending on your location within Utah the total tax you pay can be significantly higher than the 485 state sales tax. Residential properties that serve as the primary residence of any household receive an exemption of 45 of fair market value.

California 1 Utah 125 and Virginia 1. The new employer rate is assigned to employers who have less than one fiscal year July 1 to June 30 of reporting experience. Tax rates are applied to the taxable value to determine the property tax due.

These rate charts should not be used for sourcing sales from out-of-state sellers to locations in Utah. Are a Utah resident or part-year resident who must file a federal return are a nonresident or part-year resident with income from Utah sources who must file a federal return or. Earned rates are assigned to employers with one or.

Enter the amount of sales here. The state rate is 485. There are both state and local sales tax rates in Utah.

To file a Utah return first complete your federal return even if you do not have. January 1 2008 December 31 2017. Simplify Utah sales tax compliance.

Tax Rate 0. Sales of grocery food unprepared food and food ingredients are subject to a lower 3 percent rate throughout Utah. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

Utah Sales Tax Table at 485 - Prices from 100 to 4780. For security reasons TAP and other e-services are not available in most countries outside the United States. We include these in their state sales tax.

The Utah income tax has one tax bracket with a maximum marginal income tax of 495 as of 2022. There are two types of UI tax rates new employer rates and earned rates. That means the actual rates paid in Utah range from 610 to 905.

If you have grocery food sales report total tax for grocery food. In resort communities the Resort Exempt rate is the Combined Sales and Use tax rate minus the resort community tax. Grocery food is food sold for ingestion or chewing by humans and consumed for taste or.

Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or invoice. Utah has a 485 statewide sales tax rate but also has 128 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2108 on top of the state tax. Tax years prior to 2008.

Want a refund of any income tax overpaid. Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food. Grocery food does not include alcoholic beverages tobacco or prepared food.

January 1 2018 Current. B Three states levy mandatory statewide local add-on sales taxes. Thats about 409 in state sales taxes more a year equalling about 640 a year if she spends 1100 a month on.

Utah has a flat corporate income tax rate of 5000 of gross income. If a locality within a county is not listed with a separate rate use the county rate. Sales and use tax rates vary throughout Utah.

Local-level tax rates may include a local option up to 1 allowed by law mass transit rural hospital arts and zoo highway county option up to 25 county option transportation town option generally unused at present by most townships and resort taxes. Just as households spend money on various budget items taxing entities frequently have more than one budget. For more information see https.

State Income Tax Rates Highest Lowest 2021 Changes

What Is The Combined State And Local Sales Tax Rate In Each Us State Answers

How Do State And Local Sales Taxes Work Tax Policy Center

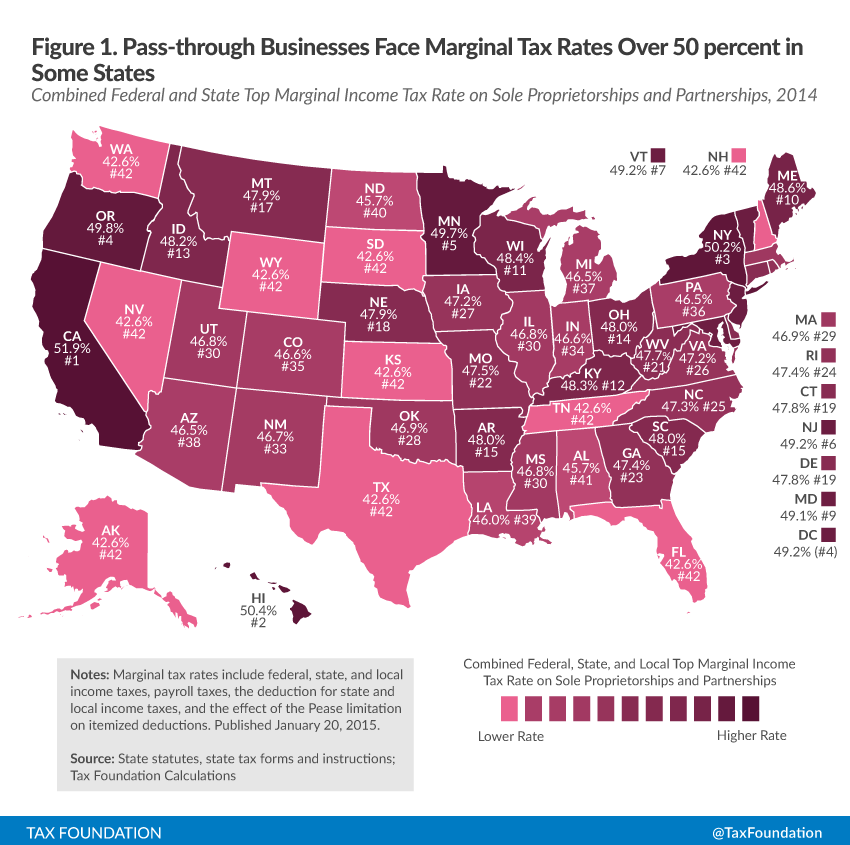

An Overview Of Pass Through Businesses In The United States Tax Foundation

States With Highest And Lowest Sales Tax Rates

Sales Tax On Grocery Items Taxjar

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

State Motor Fuel Tax Rates The American Road Transportation Builders Association Artba

How To Charge Your Customers The Correct Sales Tax Rates

Utah Sales Tax Small Business Guide Truic

There Are 9 Us States With No Income Tax But 2 Of Them Still Tax Investment Earnings Business Insider India

How Do State And Local Sales Taxes Work Tax Policy Center

From Multiple Layered Taxes To 1 Nation 1 Tax The Journey Of Indian Tax Structure Indiantaxation History 1nation1ta Journey India Latest News National

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)